Outlook for the Vietnamese Banking Sector in 2023

Outlook for the Vietnamese Banking Sector in 2023

After an impressive profit growth in 2022, banks are projected to experience a slower growth in 2023 due to the general economic challenges.

Global and domestic economies face numerous challenges

The global economy in 2023 is forecasted to slow down, approximately 2 - 2.8% (according to WB and IMF), compared to the growth of 3.4% in 2022. Inflation in most countries around the world is gradually cooling down after reaching its peak in Q3/2022 but remains at a high level. According to the latest WB forecast (April 2023), the global CPI is expected to decrease from 7.6% in 2022 to around 5.2% in 2023.

The Vietnamese economy and financial markets still encounter various domestic and international risks, such as an unfavorable international environment reducing demand for exports, investment, consumption, and international tourism; slow disbursement of public investment; increasing non-performing loans despite being under control; risks in corporate bonds (CB), stock markets, real estate (RE) still exist and require time for recovery; and interest rates are still high.

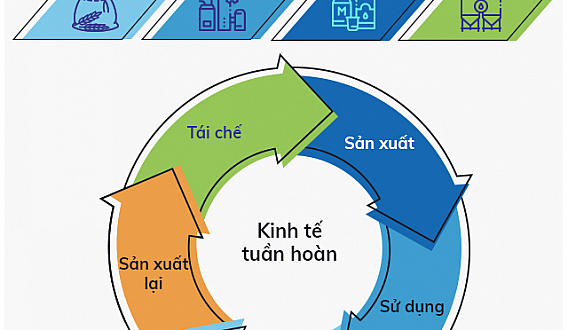

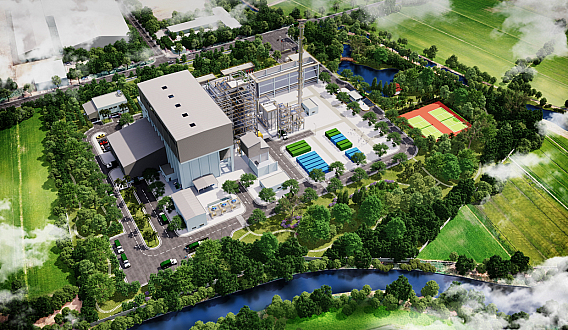

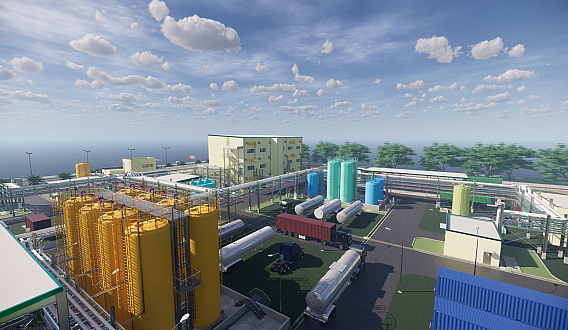

However, there are still many opportunities for the Vietnamese economy and financial markets, including: (i) The global economy is expected to experience only mild and short-term recession; FDI is forecasted to continue growing optimistically due to investors' long-term prospects for Vietnam, as evidenced by the expanded investments from Samsung, LG, Foxconn, Lego, etc.; (ii) China's reopening will positively impact Vietnam's economic growth; (iii) The government is determined to boost public investment disbursement, the 2022-2023 Recovery Program, and national target programs; (iv) Growth drivers from the digital economy, green economy, circular economy, and institutional improvement, enhancing the investment and business environment, are being actively promoted, along with many policies to remove obstacles for the capital and real estate markets.

Positive and challenging factors for the banking industry

Interest rates are expected to continue decreasing in the remaining months of 2023 due to the impact of the State Bank of Vietnam's interest rate reduction policies (usually with a lag of 3-6 months) and the influence of the Federal Reserve slowing down its rate hikes, even stopping the rate hike.

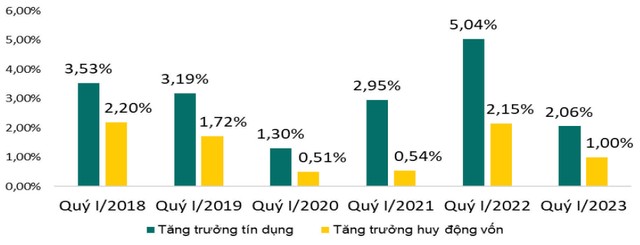

With the declining interest rate trend and supportive policies issued since the beginning of the year, credit and capital mobilization growth is forecasted to accelerate from Q2/2023 after a slow increase in the first 4 months of the year (ending Q1/2023, it was 2.06% and 1%; ending April 2023, it is nearly 3% and about 1.5% compared to the beginning of the year, much lower than the same period in 2022 and the years before the Covid-19 pandemic) (Figure 1). The forecasted credit growth for the whole year 2023 will be around 14 - 15%.

The credit structure continues to focus on capital for production and business, especially priority sectors, and growth drivers following the government's direction. Real estate (RE) credit is expected to slow down but still higher than the general growth rate. According to the State Bank of Vietnam (SBV), by the end of Q1/2023, RE credit reached over VND 2.6 million billion, increasing by 2.19% compared to the end of 2022. In which, housing RE credit increases slowly, reaching only 0.25% and accounting for 67% of the total debt for the RE sector; business RE credit increases by 6.45%, accounting for 33%.

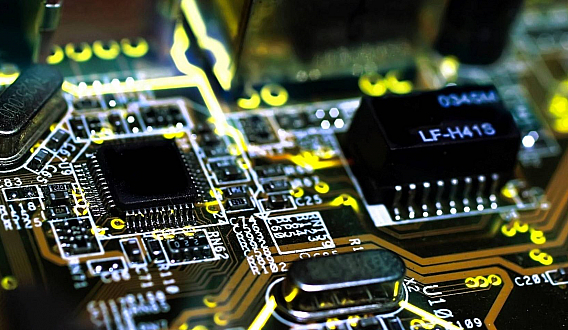

Another positive factor for the Vietnamese banking industry is the ongoing strong digital transformation trend, which may help credit institutions enhance customer experience and business efficiency. Along with the development of online banking and mobile banking, recent banks have also utilized artificial intelligence (AI) to assist customers in managing accounts, answering inquiries, and analyzing customer behavior. As a result, the scale of Vietnam's digital financial services market is forecasted to continue growing rapidly in the coming period.