The Vietnamese household goods sector has great growth potential

The Vietnamese household goods sector has great growth potential

Speech at the Conference "Competition of the Vietnamese Home Appliance Industry" in the context of global integration. "Investment opportunities in the Home Appliance Industry" on December 21. Managers and economists all agree that the Vietnamese home appliance industry has great growth prospects.

Fast growth prospects

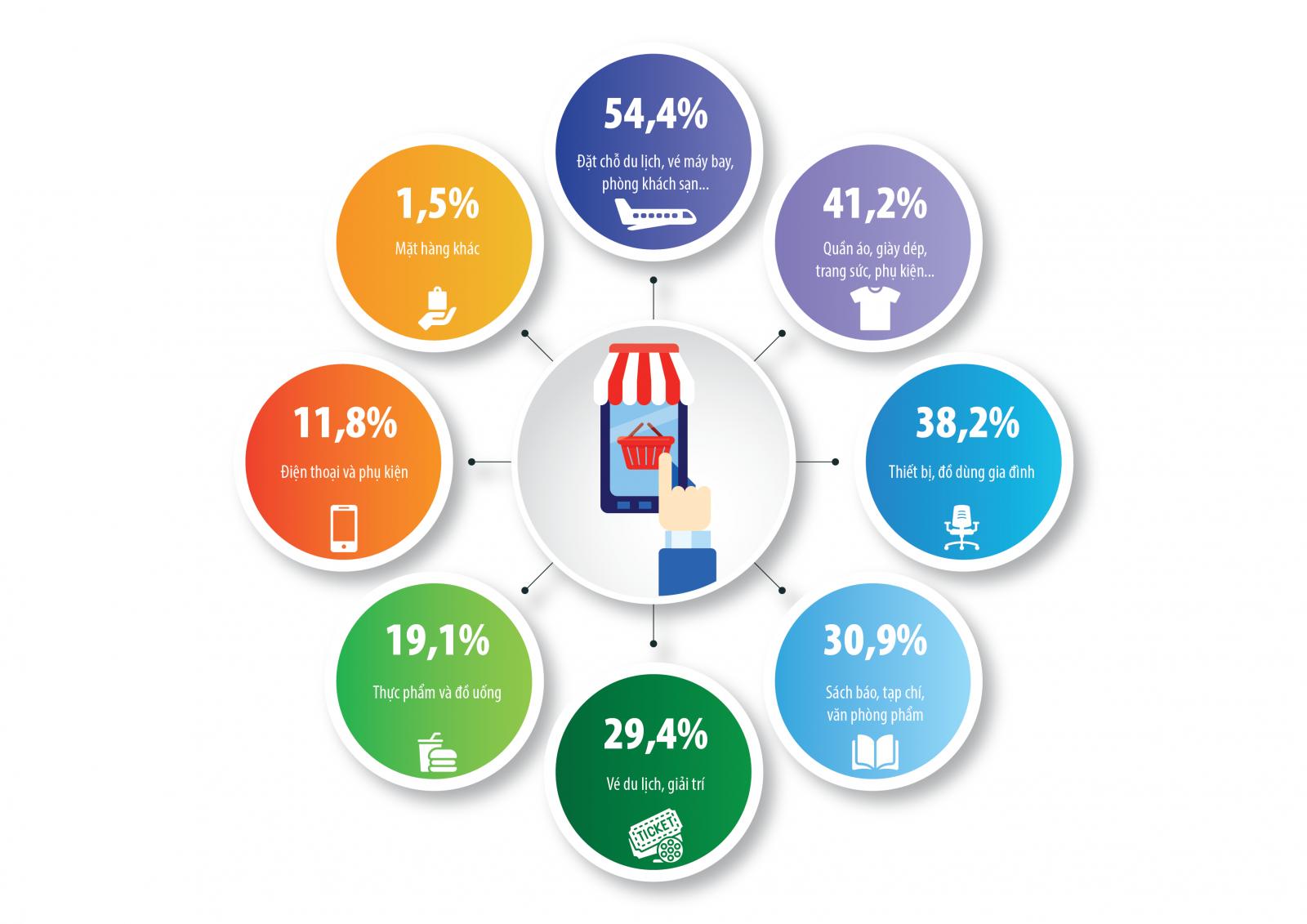

According to Mr. Vo Van Quyen, Head of the Domestic Market Department - Ministry of Industry and Trade. Currently, household appliances account for 9% of total personal consumption. And among the 11 major industry groups, the household appliance group ranks fourth in consumption scale. The domestic market size of the home appliance industry is about $12.5 - $13 billion with a higher-than-average growth rate. Specifically, in 2014, retail sales increased by 10.65%, while this group of products increased from 12 to 14%. Although in the first 11 months of 2015, these figures were 9.44% and 14.9%, respectively.

Mr. Quyen assesses the prospects of the home appliance industry as very promising. The reason is: the young population leads to a high demand for household appliances (57-60% for ages 18-45); Increasing income (over $2,000) leads to changes in demand for higher quality, more designs; The proportion of consumers interested in Vietnamese products is increasing; according to statistics, in the supermarket system of Vietnam, 85-95% are Vietnamese brands such as Happy cook, Sunhouse, Son Ha, Tan A, Dien Quang... They are dominating the market thanks to technology, pricing, and widespread distribution systems. The rural market is shifting from using homemade household items to using familiar Vietnamese brands.

Competition in the context of integration

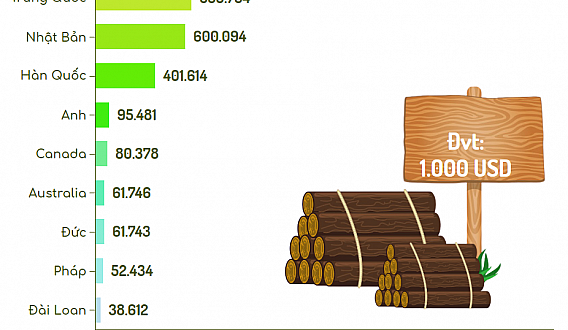

Regarding competition in the context of integration, Mr. Quyen said that new agreements signed in 2015 such as TPP, FTA with Japan, Korea, and other partners have opened up opportunities and challenges for Vietnamese manufacturing industries, including the home appliance industry. Many preferential tax commitments in many international commercial zones have been passed. For the EU market - the group of handbags, luggage, plastic, ceramics, and glass products, taxes will be eliminated immediately upon entry into force. For the US market - 85% of footwear will be exempted from import taxes immediately. Nearly 50% of plastic imports will be exempted from taxes immediately. The remaining will be eliminated in the third or fifth year. For the Japanese market - nearly 85% of the import turnover will be exempted from taxes immediately.

Excitement of Businesses

From the perspective of businesses, Mr. Le Hoang Ha - Chairman of the Board of Directors of Son Ha Saigon Corporation, said: "All Vietnamese businesses feel excited about integration."

"However, policymakers and managers are still concerned about how integration will turn out. Therefore, in addition to relying on government mechanisms, businesses need to actively adapt to the integration context. Specifically, Son Ha has been exploring exports for over 10 years, but only started implementing it in the past 5 years. The reason for this process is because businesses need to consider whether their product quality can meet the needs of the global market, as well as thoroughly understand the rules of international trade," Mr. Ha remarked.

Vietnamese Businesses Need to Change

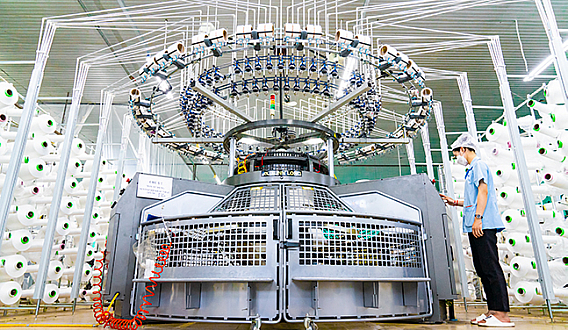

According to Mr. Ha, the greatest value of integration is the opportunity for businesses to bring their goods to other potential markets. Vietnamese businesses certainly need to change, especially in terms of technology, but it is not possible to change production lines overnight. Before 2015, Son Ha mainly exported to neighboring countries such as Laos and Cambodia. Now, they have invested in production lines to manufacture high-end products for export to the United States and Canada. However, if businesses are not strong in the domestic market, it will be difficult for them to export strongly because the international market contains many risks.

Challenges in integration

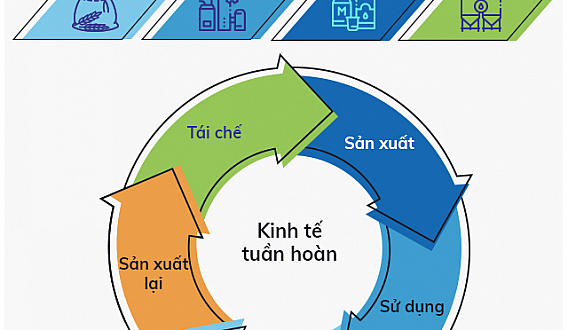

Mr. Nguyen Xuan Phu, Vice Chairman of the Young Entrepreneurs Association of Hanoi and Chairman of the Board of Directors of Sunhouse Group Joint Stock Company, also shared that the household appliance industry will be extremely promising in the next 3 years due to several factors. This is a usage industry, not a basic material business. Especially when the retail price of finished products is almost unchanged, while the prices of basic materials are in a downward cycle and are expected to continue to decline for the next 3 years. The household appliance industry does not require too high technology and uses a lot of labor. This has been China's strength in recent times. However, in the future, China's labor costs will increase rapidly as people's incomes have developed. China cannot continue to pursue this low-cost strategy. At that time, Vietnam will be a potential market to replace China in exports, with the market shifting of multinational corporations.

Consumer trends demand product diversity

The challenge is that currently, a lot of competitors from Thailand, South Korea, etc., will also benefit from the 0% tax. This will give an advantage to trading companies and be a disadvantage to domestic manufacturing companies. The risk of losing the domestic market is significant. This is because the trend of consumer demand requires product diversity, which is not the advantage of Vietnamese businesses. Therefore, pure Vietnamese companies need to focus on the export market. However, this is still a challenge due to the lack of macro support policies, not delving into each industry or internal issues of businesses, such as human resources. It is forecasted that in the next 3-5 years, pure Vietnamese businesses will face extreme difficulties.