The electronic components manufacturing industry benefits from the trend of supply chain relocation

The electronic components manufacturing industry benefits from the trend of supply chain relocation

That was the sharing of Mrs. Do Thi Thuy Huong, Vice Chairman of the Vietnam Supporting Industries Association (VASI), Member of the Executive Committee of the Vietnam Electronics Industries Association (VEIA) at the Conference on the situation and proposals, solutions to overcome difficulties, and support production and business in the last 6 months of the year organized by the Ministry of Planning and Investment on June 27.

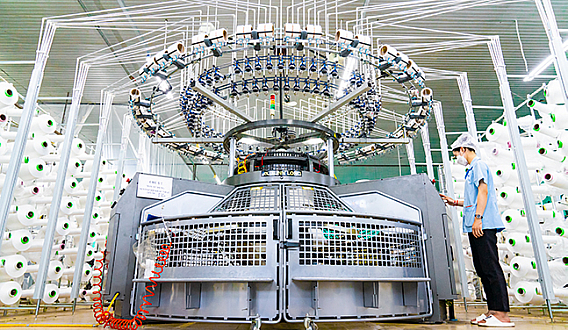

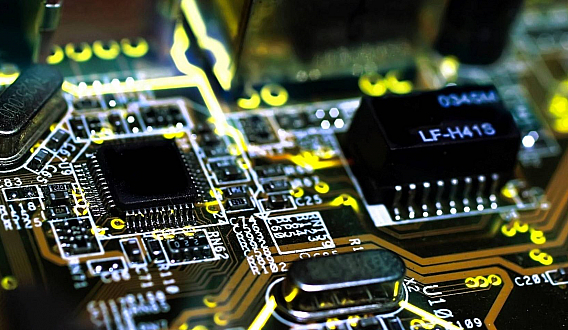

According to the Vice Chairman of VASI, the impact of the COVID-19 pandemic, the conflict between Russia and Ukraine, and China's Zero-COVID policy have caused raw material prices to skyrocket, supply chains of electronic component production to be disrupted, seriously affecting the Vietnamese supporting industries, especially the electronic component manufacturing industry.

"Regarding the electronic component manufacturing industry, China's Zero-COVID policy has caused many companies to lack production materials, especially semiconductors," said Mrs. Huong.

Due to the shortage of production materials, Vietnamese electronic businesses have had to reduce their production output. In May 2022 alone, it decreased by 20%.

In addition, the supporting industry, in general, and the electronic component manufacturing industry, in particular, are also facing a shortage of labor, especially skilled labor and those with high qualifications.

However, according to Mrs. Huong, the Vietnamese electronic component manufacturing industry still has certain advantages, such as benefiting from the trend of supply chain shifts. Major companies around the world are moving their factories and production chains from China to neighboring countries.

Among them, manufacturers in the global supply chains of these major companies are gradually focusing on Vietnam: Apple has shifted 11 factories of Taiwanese companies (in China) in its supply chain to Vietnam; many other companies such as Foxconn, Luxshare, Pegatron, and Wistron are also expanding their existing production bases in Vietnam...

For Samsung, the decision to strengthen its presence in Vietnam is quite clear as the company builds its largest research and development center in Southeast Asia worth USD 220 million in Hanoi. Samsung also plans to continue expanding its factories in Bac Ninh and Thai Nguyen. Earlier this year, Dong Nai granted investment licenses for two USD 100 million projects of Hansol Electronics Vietnam (South Korea), a component supplier for Samsung.

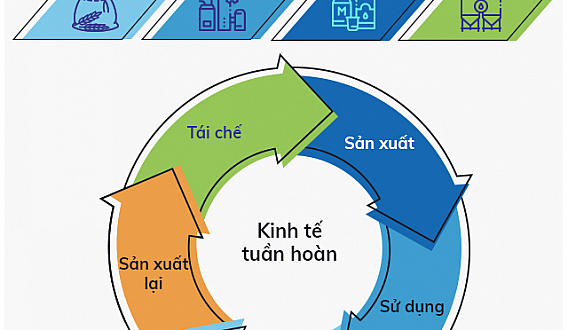

To seize these opportunities, the Vice Chairman of VASI proposed that the government should have selective policies to attract foreign giants to Vietnam, but these policies must be accompanied by conditions of clean production, environmental protection, and no discharge into the environment.

In addition, Ms. Huong suggested some issues such as the need for more policies to support improving the quality of the workforce, and functional agencies should create more favorable conditions for enterprises to access government credit support policies.