Potential, Opportunities And Barriers For The Development Of Transportation And Logistics Industry In Vietnam

Potential, Opportunities And Barriers For The Development Of Transportation And Logistics Industry In Vietnam

1. Potential for growth in transportation and logistics industry

The transportation and logistics industry in Vietnam has a lot of potential for growth, as the government has implemented policies to support its development, along with the trend of global economic integration, the signing of many trade agreements, the strong development of the e-commerce market, and the automation of the industry.

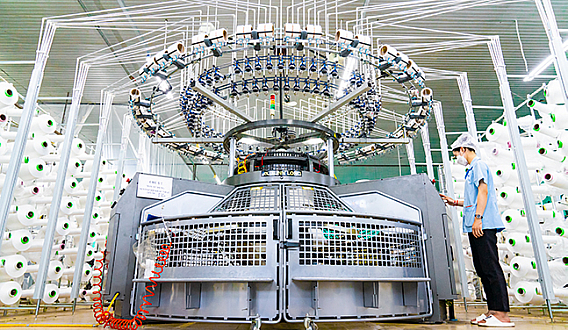

In addition, the industry has also benefited from the US-China trade war, as many Chinese companies have relocated their factories to Vietnam and Southeast Asia. According to a survey conducted by Vietnam Report, nearly 91% of businesses believe that the growth rate of the industry in 2020 will be over 10%, and many experts predict that the growth rate could reach 14% - 16%, based on the average index of recent years.

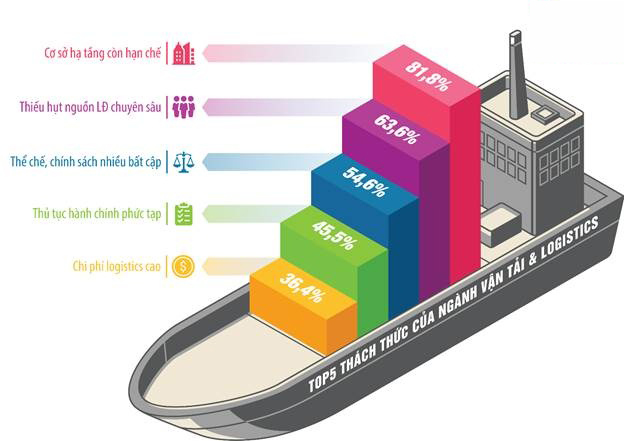

Infrastructure is a major challenge for many businesses, with 81.82% of them choosing it as their top priority. Currently, the commercial infrastructure, transportation infrastructure, and information technology infrastructure are still underdeveloped, leading to many difficulties in providing multi-modal transportation services, and the logistics costs in Vietnam are much higher than those in other countries. The construction of centralized storage facilities in the three regions, along with the warehouse and port systems, and transportation networks, has only just begun and is not yet complete, and can only meet the demand for import and export. The warehouse system has not yet met the domestic demand, especially the demand for E-Logistics.

2. Opportunities for promoting the development of logistics industry and challenges

Currently, Vietnam is evaluated as having many opportunities to promote the development of the logistics service industry. Specifically, the road transport infrastructure system, airports, seaports, warehouses, commercial infrastructure, and logistics centers are constantly expanding on a large and wide scale. Along with that, accompanying services are timely meeting the extremely diverse requirements of the market.

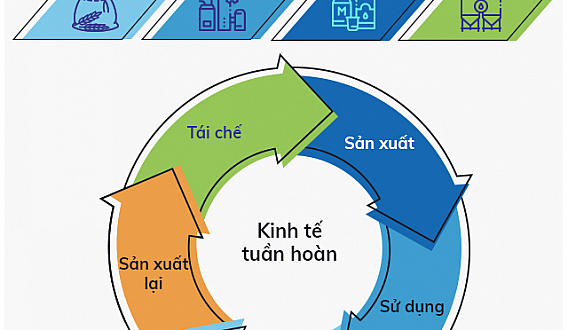

With a 70% Internet usage rate among the Vietnamese population, with an average of 28 hours per person per week, it has created conditions for the strong development of e-commerce. In 2018, according to the report of the Vietnam E-commerce and Digital Economy Agency, the e-commerce market reached $8 billion, with a growth rate of 30% compared to 2017, and it is forecasted to continue to grow strongly in the coming years, reaching $10 billion in 2020. E-commerce development has led to many consumers switching to online shopping and the development of new business models for courier service companies with a large number of small and frequent deliveries and wide coverage of services across provinces and cities.

3. Some challenges and obstacles

The logistics industry, in general, and logistics companies in Vietnam, in particular, still face many challenges and obstacles, specifically:

Firstly, the institutional framework and policies for the logistics sector are not yet consistent, and there are still some shortcomings. Regarding the legal framework for the logistics industry, there are currently many documents, but specific policies that detail the specific directions are still not implemented or are overlapping.

Two, the transportation infrastructure is still weak, inconsistent, and has not created a multimodal transport corridor while the demand for high-quality transshipment of goods between modes is increasing. In reality, the connection of transportation modes is not yet efficient, and resources in infrastructure, human resources, domestic and regional markets, and logistics centers that play a role in connecting Vietnam with the international market have not been invested in, leading to high logistics costs, accounting for 25% of GDP (compared to developed countries which only account for 9 to 15%), in which transportation costs account for 30 to 40% of product costs (compared to 15% in other countries). This reduces the competitiveness of services and goods of Vietnamese companies and affects the competitiveness of the Vietnamese economy.

Three, the activities of logistics companies still have many limitations in terms of operation scale, capital, human resources... Logistics service providers in Vietnam are mostly small and medium-sized enterprises, operating logistics services with limited experience and professionalism, providing basic services or only providing individual services, mainly competing on price, with little value-added. They usually play the role of subcontractors or agents for foreign companies. The main logistics services that Vietnamese logistics companies provide to customers are warehousing, freight transportation, goods delivery, loading and unloading, sorting, packaging, storage... while other services in the logistics service chain are provided by some companies, but the quantity is not large and has not been focused on for development.

Four, the human resources serving logistics services have not been systematically trained, and are still lacking and weak, not meeting requirements, especially lacking skilled logistics personnel with the capacity to apply and deploy in enterprises.