Report on the electronic components manufacturing industry in Vietnam

Report on the electronic components manufacturing industry in Vietnam

According to statistics from the Ministry of Industry and Trade on the electronic components manufacturing industry in Vietnam, in the first six months of 2022, it increased by 16.4% compared to the same period last year. Despite facing many difficulties due to Covid, the export turnover of computers and electronic components in May 2022 reached over $4.85 billion, an increase of 8.64% compared to the previous month and 25.18% compared to the same period in 2021.

1. Growth remains strong despite

Covid-19 According to the Ministry of Industry and Trade, in 2021, businesses faced many difficulties in importing components from China due to Covid-19.

After the Covid-19 pandemic, thanks to the reasonable balance in the production and business activities of enterprises, localities across the country have adapted safely, flexibly, and effectively controlled the situation. Therefore, the electronic industry still maintained a strong growth in both industrial production index and export turnover.

In 2022, the industrial production index of the electronic product manufacturing industry, computer and optical products increased by 25.18% compared to the same period last year.

The export turnover of the processed industrial goods continued to contribute significantly to the overall growth rate of export activities, reaching an estimated $243 billion, up 17.4% compared to the same period last year, accounting for 86% of the total export turnover. Telephones and components increased by 10.7%; computers, electronic products and components increased by 13.3%; cameras, camcorders, and components increased by 38.9%.

In May 2022, the export turnover of computers and electronic components of FDI businesses reached over $4.79 billion, up 9.06% compared to the previous month and up 26.46% compared to May 2021, accounting for over 98.77% of the total export turnover of computers and electronic components in Vietnam.

In the first five months of 2022, the export turnover of computers and electronic components of FDI businesses reached over $22.13 billion, up 14.42% compared to the same period last year, accounting for 98.33% of the total export turnover of this commodity in the country.

Source: Calculated from data of the General Department of Customs

Source: Calculated from data of the General Department of Customs

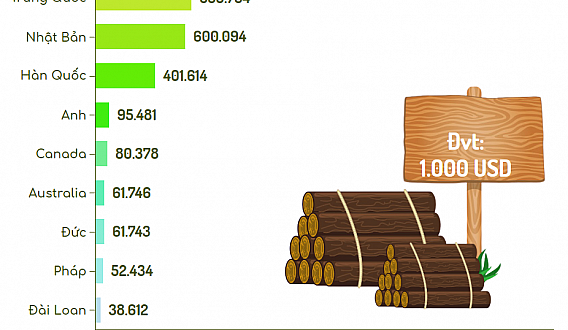

Export market of Vietnam's computer and electronic components as of May 2022:

-

Smartphones and components exports reached USD 22.5 billion, up 14.13% compared to 2021.

-

Exports of smartphones and components to the Chinese market reached USD 4.68 billion, down 1.98%.

-

Exports of smartphones and components to the US market reached USD 5.77 billion, up 18.7%.

-

Exports of smartphones and components to the EU (27 countries) reached USD 2.8 billion, up 3.36% compared to last year.

As of the end of the first 5 months of 2022, the main export markets for this product include China, the United States, the EU, Hong Kong, South Korea, and ASEAN. Exports to these six leading markets accounted for over 83.41% of the country's total export turnover of this product.

According to the Ministry of Industry and Trade's assessment, in the context of the ongoing complicated developments of the Covid-19 pandemic, the production, business, and trade activities of the electronics industry have generally maintained an unchanged speed and achieved a relatively high growth rate in the recent period. Particularly important are consumer electronics products such as TVs, washing machines, air conditioners, refrigerators, and mobile phones.

2. Formation of a potential domestic business network

Vietnam is among the top 12 countries with large electronics exports in the world and ranked 3rd in ASEAN, but about 95% of the value belongs to enterprises with international investment capital (FDI).

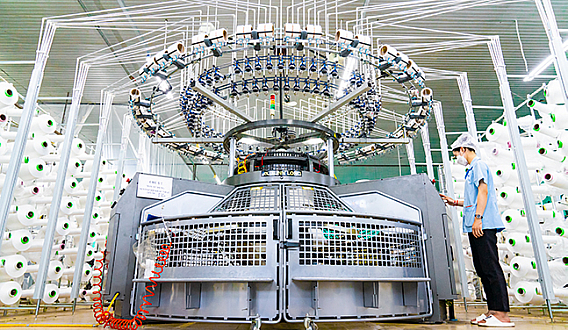

Although considered as a leading industry and achieving some success in attracting foreign direct investment and playing a major role in exports, Vietnam's electronics, computer, and component sector is still in its early stage in the production chain of electronic products and heavily dependent on foreign direct investment enterprises, with multinational corporations playing a major role, particularly those from South Korea, Japan, etc. in the service industry for manufacturing prototypes and electronic component production.

Vietnamese companies' products have not yet strongly focused on deep processing and developing high-tech and high-value-added processed or manufactured products for export. The proportion of high-value-added processed and manufactured products is still low. Most of the electronic products on the market are imported as fully-assembled products or assembled in the country using mostly imported components.

Each year, Vietnam imports nearly $50 billion worth of electronic components, while the capacity of domestic electronic companies to participate in the global value chain is still very limited.

Therefore, the growth of the electronics industry needs to take a step up to promote growth. Domestic enterprises need to participate more in the global value chain, establish a supportive industrial ecosystem, and have the capability to collaborate with large international advanced technology corporations.

3. Supply chain shift trend

Due to the impact of the COVID-19 pandemic, the Russia-Ukraine conflict, and China's Zero-COVID policy, prices of materials and components have skyrocketed.

The supply chain for component manufacturing has been disrupted, severely affecting Vietnam's supporting industries, especially the electronic component manufacturing industry.

Due to the lack of production materials, Vietnamese electronics companies have had to reduce their output, with a 20% reduction in May 2022 alone. In addition, these companies are facing a shortage of skilled labor and high-level workers.

However, the Vietnamese electronic component manufacturing industry still has some advantages, such as benefiting from the trend of shifting supply chains. Large corporations around the world are shifting their factories and supply chains from China to surrounding countries.

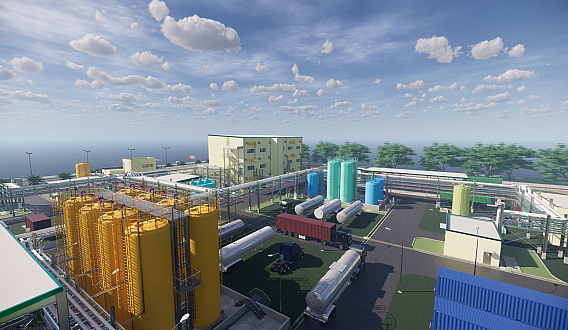

In particular, manufacturers in the global supply chains of these large corporations are gradually focusing on Vietnam: Apple has shifted 11 factories of Taiwanese companies in its supply chain from China to Vietnam; many other companies such as Foxconn, Luxshare, Pegatron, and Wistron are also expanding their existing production facilities in Vietnam...

For large companies like Samsung, the decision to develop more in Vietnam is quite clear as they have built the largest research and development center of the corporation in the Southeast Asia region worth 220 million USD in Hanoi. Samsung is also planning to expand its factories in Bac Ninh and Thai Nguyen.

Earlier this year, Dong Nai granted investment licenses for two 100 million USD projects of Samsung's component supplier, Hansol Electronics Vietnam (Korea).

To seize these opportunities, the Vice Chairman of VASI (Vietnam Association of Supporting Industries) has suggested that the government should have selective policies to attract foreign giants to Vietnam. However, these policies must be accompanied by conditions for "clean" production, environmental protection, and no discharge into the environment.

In addition, the Vice Chairman of VASI has also recommended some issues, such as the need for more supportive policies to improve the quality of the workforce, and functional agencies should facilitate businesses in accessing the government's credit support policies.